DeFi Post-Crash: 2025's Data Discrepancy - Deep Dive Discussion

7|0 comments

Jupiter. The name conjures images of vastness, potential, maybe a little bit of science fiction. But in the crypto world, it's a Solana-based DEX aggregator. The core question, as always: is the JUP token itself a worthwhile investment, or just a shiny object orbiting a more substantial platform?

Jupiter: Marketing Hype vs. Cold, Hard Data

Jupiter's Marketing and Claims The marketing materials paint a rosy picture. We’re told Jupiter is “one of the core trading tools in the Solana ecosystem," helping users find the best possible token swap prices. That sounds good, but let's dig into the numbers, shall we?JUP's Wild Ride: Volatility as a Red Flag

JUP Token Price Volatility The article states that JUP trades around $0.35, with recent swings between $0.32 and $0.45. That volatility (roughly 28%, if you're scoring at home) is the first red flag. We need to understand what's driving these price fluctuations. The article points to major events, market trends, and investor sentiment. Vague. I want specifics.Jupiter's Fate: Riding or Sinking with Solana?

The Solana Question Mark The core argument for JUP seems inextricably linked to Solana's overall health. If Solana thrives, so too, presumably, does Jupiter. But is that relationship as ironclad as the Jupiter team would like you to believe? The article quotes DigitalCoinPrice analysts, who "show steady-growth expectations for Jupiter in 2025" and Telegaon, who "remains the most bullish."Crypto Analysis: Take It With a Grain of Salt

Skepticism Towards Crypto Analysis Sites Here's where my skepticism kicks in. Every crypto analysis site has a vested interest in showing growth. Positive headlines drive clicks, and clicks generate revenue. I'm not saying they're lying, but I *am* saying we need to apply a hefty discount to their optimism.Hacked Tweets, Real Losses: JUP's 8% Reminder

Impact of Social Media Hacking The article touches on a crucial point: the hacking of Jupiter DEX’s social media account in February 2025. No funds were lost, but the price dropped 8%. This highlights the fragility of crypto valuations. A single tweet—or, in this case, a compromised account—can erase millions in market cap. This isn't unique to JUP, of course, but it underscores the risk.Technical Analysis: A Sea of Red Flags

Technical Analysis Signals "Strong Sell" The investing.com technical analysis paints a grim picture. "Strong Sell" is the overall summary. "Out of nine tracked signals, seven flash Sell." Not exactly a ringing endorsement. Even the moving averages are bearish, with short-term averages consistently trending downward.Bearish Signals: A Chorus of Doubt

Consistency of Bearish Signals I've looked at hundreds of these technical analyses, and they often contradict each other. But the *consistency* of the bearish signals here is hard to ignore. It suggests that the market, at least in the short term, is not convinced by the Jupiter story.Jupiter's Revenue vs. Valuation: A Disconnect

Revenue vs. Market Cap Discrepancy But then, the disconnect. The Blockworks report cited in the article highlights that Jupiter generated $45 million in revenue in Q3 2025, for an annualized run rate of $180 million. Yet, JUP's market cap dropped from $3 billion to $1.1 billion. This is the part of the report that I find genuinely puzzling. How can a company with such strong revenue numbers see its valuation plummet so drastically?Jupiter's Tokenomics: A $5.5 Billion Question Mark?

Tokenomics and Early Investor Influence The answer, I suspect, lies in the tokenomics. The article mentions that Jupiter had a major community round, raising $138 million at a valuation of $5.5 billion. That's a hefty valuation for a DEX aggregator, even a successful one. It suggests that early investors may be looking to cash out, putting downward pressure on the price.Garbage In, Garbage Out: The Limits of Crypto Forecasting

Methodological Critique of Price Predictions And here's a methodological critique: all of these price predictions are based on *past* performance. But the crypto market is notoriously unpredictable. What happens if Solana experiences a major technical failure? What happens if a competitor emerges with a superior DEX aggregation technology? What happens if regulators crack down on DeFi? None of these scenarios are factored into these rosy forecasts.JUP Price Predictions: Even Experts Are Confused

Conflicting Expert Opinions Even the experts seem conflicted. The Noone Wallet Analysis Team projected that JUP could reach $0.85 by the end of 2025 (using a reference price of $0.44). That's a decent return, but it's hardly a moonshot. And they also warn of "macro risk and protocol-level challenges." In other words, anything could happen.Jupiter: Is the Rally Built on Hype or Reality?

Conclusion: Hype vs. Substance Jupiter *might* be a real Solana gem, but the current price action suggests it's more hype than substance. The revenue numbers are impressive, but the tokenomics are concerning, and the technical analysis is downright bearish. Investing in JUP is a bet on Solana, yes, but it's also a bet on the Jupiter team's ability to overcome significant headwinds. And right now, the data just isn't there to support that bet.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

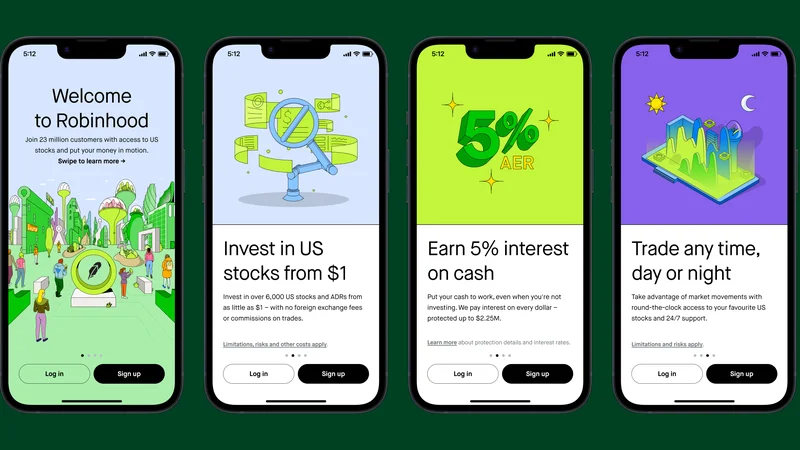

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- IE Business School Wins 2025 MBA Best In Class Award for AI: Why It Matters for the Future of Business Education

- Fintech 2025: The Human Revolution - Future is Now!

- Fintech: Your Money, Reimagined. - Reactions Incoming

- Why Crypto's Consolidation is a Giant Leap - Crypto Twitter Reacts

- DeFi Post-Crash: 2025's Data Discrepancy - Deep Dive Discussion

- Uber Ride Demand: Cost Analysis vs. Thanksgiving Deals

- Stock Market Rollercoaster: AI Fears vs. Rate Hike Panic

- Bitcoin: The Price, The Spin, & My Take

- Asia: Its Regions, Countries, & Why Your Mental Map is Wrong

- Retirement Age: A Paradigm Shift for Your Future

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)