Fintech 2025: The Human Revolution - Future is Now!

6|0 comments

Your Financial DNA: Unlocking Hyper-Personalized Fintech

The Dawn of Hyper-Personalization Okay, folks, buckle up, because the financial world is about to get a whole lot more… *you*. We're talking about fintech in 2025, and it's not just about faster transactions or slicker apps anymore. It's about crafting financial experiences that are so finely tuned to your individual needs, habits, and aspirations that it'll feel like your bank is reading your mind—well, almost. Think about it: for years, we've been swimming in a sea of generic financial products. Credit cards with cookie-cutter rewards, investment advice that feels like it's pulled from a dusty textbook. But now? Now we're seeing the rise of hyper-personalization, powered by the twin engines of AI and Big Data. Fintech firms are tapping into billions of data points – your spending habits, your location, even the time of day you buy your coffee – to build a financial ecosystem that anticipates your needs before you even realize them yourself. Imagine this: your AI-powered financial assistant notices you've been consistently browsing flights to Rome. It proactively suggests a travel rewards card with bonus miles for airline purchases, *and* it automatically sets up a high-yield savings account to help you reach your vacation goals. It's like having a financial fairy godmother, only instead of a wand, she wields algorithms. This isn't just about convenience, though. It's about empowerment. By understanding your unique financial DNA, fintech companies can offer tailored advice, identify potential risks, and help you make smarter decisions. It’s like having a GPS for your financial journey, guiding you towards your goals with laser precision. Now, I know what some of you are thinking: "Big Data? Sounds a little creepy, Aris." And you're right, we need to tread carefully. The ethical implications of collecting and using personal data are immense. We need robust regulations and transparent practices to ensure that this technology is used for good, not for exploitation. But the potential benefits are too significant to ignore. It’s a responsibility we must embrace thoughtfully.AI: Your Financial Co-Pilot, Guiding You to Prosperity

The AI Revolution: Your Financial Co-Pilot The real game-changer here is the rise of machine learning and AI. These aren't just buzzwords anymore; they're the essential ingredients in the fintech recipe. AI algorithms can analyze vast datasets, identify patterns, and predict future trends with astonishing accuracy. They can detect fraudulent transactions, assess credit risk, and even provide personalized investment recommendations. Think of AI as your personal financial co-pilot, constantly monitoring your financial landscape and alerting you to potential turbulence. It can help you navigate complex investment strategies, optimize your spending habits, and even negotiate better deals on your bills. And the speed of this is just staggering—it means the gap between today and tomorrow is closing faster than we can even comprehend. This is more than just a technological advancement, it's a fundamental shift in how we interact with our finances. We're moving away from a world of one-size-fits-all solutions to a world where financial services are customized to meet our individual needs. It's like the difference between buying a suit off the rack and having one tailored to your exact measurements. Which, in the end, fits you better? I remember when I first saw a demo of an AI-powered financial planning tool that could project my retirement savings with different investment scenarios. I just sat back in my chair, speechless. This is the kind of breakthrough that reminds me why I got into this field in the first place. But here's the question that keeps me up at night: How do we ensure that this technology is accessible to everyone, not just the wealthy elite? How do we bridge the digital divide and empower underserved communities with the tools they need to thrive in this new financial landscape? It’s a challenge that demands our immediate attention. Personalized Finance: A New Era of Empowerment Fintech has gone from a niche player to the backbone of how we manage our money. It's how we earn, invest, spend, and protect our financial lives. Data, user experience, and trust are crucial for navigating these innovations. Fintech 2025: New Waves of Innovation, Security, and User Experience | by Bhinish Dhiman | Nov, 2025 - DataDrivenInvestor We stand at the cusp of a new era, a time when financial services are as personalized and intuitive as our favorite streaming services. It's a future where technology empowers us to take control of our financial destinies, achieve our goals, and live our best lives. What does this mean for us? What could it mean for *you*? Imagine a world where financial stress is a thing of the past, where everyone has access to the tools and resources they need to build a secure and prosperous future. The Future is Finally Arriving

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

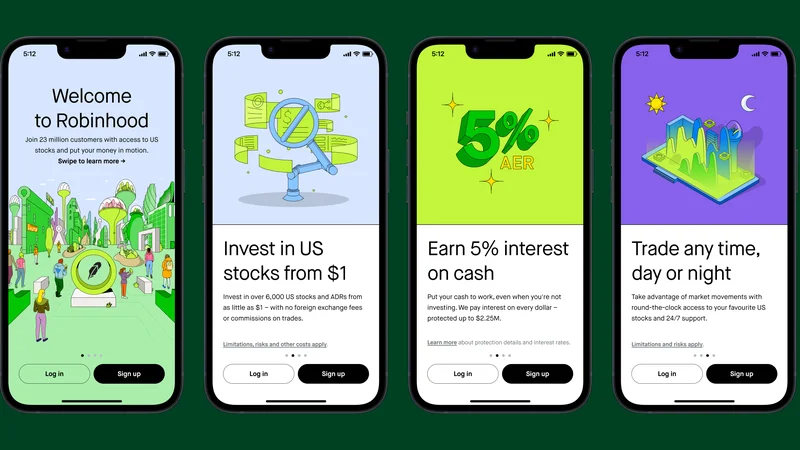

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- IE Business School Wins 2025 MBA Best In Class Award for AI: Why It Matters for the Future of Business Education

- Fintech 2025: The Human Revolution - Future is Now!

- Fintech: Your Money, Reimagined. - Reactions Incoming

- Why Crypto's Consolidation is a Giant Leap - Crypto Twitter Reacts

- DeFi Post-Crash: 2025's Data Discrepancy - Deep Dive Discussion

- Uber Ride Demand: Cost Analysis vs. Thanksgiving Deals

- Stock Market Rollercoaster: AI Fears vs. Rate Hike Panic

- Bitcoin: The Price, The Spin, & My Take

- Asia: Its Regions, Countries, & Why Your Mental Map is Wrong

- Retirement Age: A Paradigm Shift for Your Future

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)